hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea’s ambitions to become most competitive country in future automobile industry by 2030

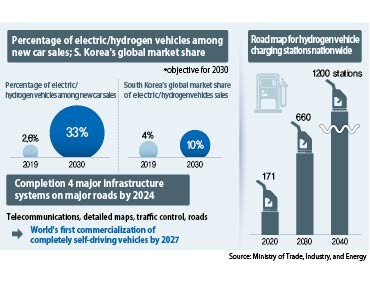

The South Korean government has presented a “future vehicle industry development strategy” with a target of making South Korea the world’s most competitive presence in the future automobile industry by 2030. The plan is focused on pushing the accelerator in innovation growth in the area of future vehicles, including commercializing completely autonomous vehicles by 2027 and increasing the percentage of eco-friendly vehicles to 33% of all new cars sold in South Korea by 2030.

Developed in collaboration by relevant ministries, a list of three chief pursuit strategies for future vehicle industry development was announced by the South Korean government on Oct. 15. The plan involves hastening technological developments, boosting domestic sales of eco-friendly automobiles, and moving the target date for commercialization of completely self-driving vehicles forward from 2030 to 2027 – all while preparing for an era of “flying cars” and other future vehicle services.

Perhaps the most attention-grabbing part of the road map is its aim of increasing the percentage of electric and hydrogen vehicles to 33% of all new cars sold in South Korea. The plan also aims to increase the global market share of eco-friendly vehicles to 10% by 2030. Electric and hydrogen vehicles currently account for just 2.6% of new automobile sales in South Korea. The government’s aim is to increase the percentage to around 10% by 2022, before eventually crossing the 30% mark in 2030. Some observers are suggesting that while the decline of internal combustion-based vehicles is inevitable, it may be going too far to predict growth in eco-friendly vehicles will be swift enough to have them accounting for a third of all new automobile sales within 10 years.

Need for overcoming practical constraints by strengthening future car “ecosystem”

The Korean Society of Automotive Engineers (KSAE) predicted that internal combustion-based vehicles would continue to account for 90% of the global automobile market by 2030. KSAE concluded that, despite the technological progress being made with hydrogen and electric vehicles, they are not expected to be sufficiently economical and convenient for widespread adoption by the public in the near future. Another roadblock to popularization lies with the makers of traditional finished vehicles, who are reluctant to give up on internal combustion-based vehicles in the face of current market demands.

The South Korean government’s plan is to overcome practical constraints by strengthening the future automobile “ecosystem.” In particular, it plans to undertake a swift transition toward an open future vehicle ecosystem through 60 trillion won (US$50.5 billion) in private investment, coming chiefly from Hyundai and Kia Motor. To aid the shift of parts companies to automotive electronics, it plans to provide 2 trillion won (US$1.68 billion) for facility investment and short-term liquidity supplies, as well as 96 billion won (US$80.8 million) in support next year to assist a transition in projects. It also presented the target of achieving the world’s first commercialization of completely self-driving vehicles. As part of this, it aims to have systems and infrastructure (major roads) in place for autonomous vehicles by 2024 and launching self-driving vehicles meeting SAE International standards for “level four” automation, with self-driving vehicles to be commercialized for major roads nationwide by 2027.

The South Korean government’s measures are drawing attention for coming at a transitional moment when the boundaries of the global automobile industry are undergoing limitless expansion. Domestic automobile production last year totaled 193 trillion won (US$162.44 billion), or 13% of all manufacturing, with its total of 400,000 jobs accounting for 11% of employment. South Korea was previously ranked fifth in the world for automobile production, but has slipped to seventh place behind India and Mexico. The future vehicle industry comes as both a crisis and an opportunity for the automotive industry.

Requires considerable time and large-scale investments

It remains uncertain whether the government’s future vehicle development strategy will go ahead as planned. In addition to the considerable time and monetary investments needed to establish the necessary systems and infrastructure for self-driving vehicles, large-scale private investment is not something that can be elicited through the government’s will alone.

“I think this latest strategy is a bit more fleshed out and includes more challenging targets than the future vehicle measures that have been announced to date,” said Lee Hang-koo, a senior research fellow at the Korea Institute for Industrial Economics and Trade.

“If you take into account the way boundaries between industries have been falling, you can’t just have Hyundai Motor doing this on its own. The only way to achieve results will be when we bolster cooperation with parts industries and among the relevant ministries,” Lee said.

By Hong Dae-sun, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 4[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 5S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 6Why Israel isn’t hitting Iran with immediate retaliation

- 7[Guest essay] How Korea turned its trainee doctors into monsters

- 8Japan officially says compensation of Korean forced laborers isn’t its responsibility

- 9[Editorial] Does Yoon think the Korean public is wrong?

- 10[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten